Introduction to Coding, Billing, and Reimbursement

1. Why do we code?

Accurate knowledge of billing and coding is vitally important to family physicians for maintaining financially stable practices. However, it can be confusing and may sometimes seem superfluous to providing good patient care. We hope this unit clarifies the rubrics of billing and coding and reveals just how important this knowledge is for you, for your patients, and for your future practice.

In pre-computer days of medicine, each physician would handwrite a “bill of service” with a narrative description of the diagnosis and medical services provided, and whatever charge they deemed appropriate. It was easy to “write off” charges at the discretion of the physician. As offices modernized, computers began to manage both bills and receipts; that and the rise of health insurance plans resulted in the need for standardized codes for billing purposes. Computerized billing and coding programs were eventually developed to extract information from the EHR and send bills to health insurance companies and to patients. However, the need for both physicians and personnel to be trained in billing/coding is essential as billing rules continue to change.

2. What are CPT Codes?

There are two types of codes frequently used by physicians and other qualified healthcare professionals: CPT codes and ICD-10 codes. The Current Procedural Terminology (CPT©) codes describe the type of medical service provided and can be used for billing, whereas ICD-10 codes are diagnosis codes. CPT codes are created and copyrighted by the American Medical Association (AMA) and are currently in the fourth major edition. Initially, the Center for Medicare and Medicaid Services (CMS) adopted the AMA’s CPT codes and, subsequently, private health insurance organizations also purchased use of these codes. Adoption of CPT codes then became required by the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and these codes were later extended by the Patient Protection and Affordable Care Act (ACA) in 2010.

CPT codes were initially designed for surgeries and other procedures, hence the use of the word “procedural.” However, these codes were later expanded to over 10,000 medical services including outpatient visits, inpatient care, vaccine and medication administration, screenings and evaluations, risk-reduction counseling, laboratory and radiology services, and many other types of services. You can think of CPT codes as a “Product Inventory” for all types of healthcare services with each “product” designated by a code with an accompanying description.

Internally, the CPT coding structure is divided into 3 categories. As a physician, you will use Category 1, which involves the services that physicians, other healthcare professionals (like nurses), or healthcare systems provide. Category 2 and 3 cover non-reimbursable performance improvement markers and temporary codes for experimental or emerging therapies, which you will not use for regular practice. Within Category 1, you will primarily use the Evaluation and Management (E/M) codes (both inpatient and outpatient), along with some procedure and counseling codes. The majority of this unit covers commonly used CPT codes in detail.

3. What is the International Classification of Diseases (ICD)?

The International Classification of Diseases (ICD) is a coding system of diseases and other medical conditions, and also includes some procedural codes. It was first produced by the World Health Organization (WHO) in 1983 and is used globally for standardization and tracking of diseases. Like CPT codes, ICD codes were mandated in the 1996 HIPPA legislation. The tenth edition (ICD-10) was approved internationally in 1995, but was only implemented in the USA in 2015. There are currently about 70,000 diagnosis codes and 72,000 procedural codes. The release of ICD-11 was released internationally in 2022 but may not be adopted in the US for some time. The entire ICD coding system is available for download at the CDC's website.

ICD-10 are codes by letter. It can also be important to specify which side of the body is involved and other qualifiers, such as if it is an initial or subsequent encounter. that indicate diseases and medical conditions (including signs/symptoms). The ICD-10 codes are alphanumeric and can contain up to 7 characters. The categories are arranged by body systems, which are grouped together

ICD-10 are codes by letter. It can also be important to specify which side of the body is involved and other qualifiers, such as if it is an initial or subsequent encounter. that indicate diseases and medical conditions (including signs/symptoms). The ICD-10 codes are alphanumeric and can contain up to 7 characters. The categories are arranged by body systems, which are grouped together

This table shows the various organ systems and ICD-10 blocks. We include this so you have a better idea of why certain codes are coded as they are and to assist in identifying related codes. It’s not important to commit to memory. Note that Z-codes can be helpful for wellness diagnoses and various screenings when a disease or disorder is not known to be present.

|

ICD-10

Block

|

System

|

|

A00–B99

|

Certain infectious and parasitic diseases

|

|

C00–D48

|

Neoplasms

|

|

D50–D89

|

Diseases of the blood and blood-forming organs, and certain disorders involving the immune mechanism

|

|

E00–E90

|

Endocrine, nutritional and metabolic diseases

|

|

F00–F99

|

Mental and behavioral disorders

|

|

G00–G99

|

Diseases of the nervous system

|

|

H00–H59

|

Diseases of the eye and adnexa

|

|

H60–H95

|

Diseases of the ear and mastoid process

|

|

I00–I99

|

Diseases of the circulatory system

|

|

J00–J99

|

Diseases of the respiratory system

|

|

K00–K93

|

Diseases of the digestive system

|

|

L00–L99

|

Diseases of the skin and subcutaneous tissue

|

|

M00–M99

|

Diseases of the musculoskeletal system and connective tissue

|

|

N00–N99

|

Diseases of the genitourinary system

|

|

O00–O99

|

Pregnancy, childbirth and the puerperium

|

|

P00–P96

|

Certain conditions originating in the perinatal period

|

|

Q00–Q99

|

Congenital malformations, deformations and chromosomal abnormalities

|

|

R00–R99

|

Symptoms, signs and abnormal clinical and laboratory findings, not elsewhere classified

|

|

S00–T98

|

Injury, poisoning and certain other consequences of external causes

|

|

V01–Y98

|

External causes of morbidity and mortality

|

|

Z00–Z99

|

Factors influencing health status and contact with health services

|

|

U00–U99

|

Codes for special purposes

|

4. Why does ICD-10 coding matter?

Residents usually have some familiarity with CPT coding by the time they graduate. However, some may not appreciate the importance of ICD-10 codes, both for accurate reporting of diagnoses and for reimbursement. When your office sends a bill for reimbursement, health insurance payers usually do not have access to your entire clinical documentation. Instead, they receive ICD-10 and CPT codes for the patient’s care. Based on this limited information, they must make a determination about whether to pay for the medical services and also evaluate the complexity of the care provided (which can impact reimbursement). Using inaccurate or vague diagnosis codes may delay and potentially reduce reimbursement. Payers may request clarification or may choose not to reimburse at all, even with correct CPT coding. In other words, even if you correctly bill for an office visit as a 99214, if you do not include appropriate ICD-10 codes, you may not be paid!

In a hospital setting, accurate ICD-10 diagnosis codes are equally important for patient care and accurate charting, as well as to support the CPT codes for inpatient physician services. They are also essential for appropriate hospital reimbursement for the patient’s care, without which hospitals are unable to stay financially viable. Hospital costs include room and board, care from nursing and other essential hospital staff, patient monitoring (telemetry), etc.

Health insurance payers calculate an estimated hospital reimbursement rate, called the Prospective Payment System (PPS), based on the combined severity of the principal diagnoses, secondary diagnoses and comorbidities, interventions provided, and other relevant factors (such as age or smoking status). These are combined into a scoring system called the Diagnosis Related Group (DRG). The DRG then provides a reimbursement rate per diem for that patient’s inpatient care needs, based on the anticipated average length of stay for that particular DRG. The reason for this complicated system is to prevent hospitals from doing unnecessary procedures and/or prolonging hospital stays simply for more reimbursement. Conversely, it makes sure hospitals and patients are not unexpectedly surprised with major expenses for a sick patient if the payer refuses to pay. Finally the DRG allows for some standardization of the costs of hospital care.

For these reasons, physicians should document all pertinent diagnoses at the time of admission and add any new ones throughout the course of hospitalization. The hospital’s Utilization Management team reviews these on an ongoing basis and interacts with health insurance to help calculate or adjust the DRG. For example, if a new problem arises during the hospitalization, the DRG may change and this may allow for ongoing reimbursement. However, if the ICD-10 codes provided by the physician are unclear or not specific enough, the team will contact the physician to ask for clarification of the medical records. Remember, legally, only a physician can provide or change a medical diagnosis.

Other important aspects of accurate ICD-10 codes involve quality improvement, value-based care, and public health. Accurate coding allows extraction of diagnostic information from your electronic health records to improve your own quality outcome measures or those of your practice. For example, you can search for all your patients with diabetes, then review their HbA1c levels to see how well your patient panel is managed. As outcomes-based reimbursement becomes more popular (called value-based care), appropriate ICD-10 documentation will also become increasingly important in order to prove your patient outcomes are excellent. In terms of public health, accurate diagnosis allows better monitoring and research into diseases, population trends and various interventions. Finally, it is unprofessional and may be deemed as fraud to intentionally document inaccurate ICD-10 or CPT codes.

5. How do I get paid?

So how does an office visit become dollar bills in your paycheck? It depends on how your practice is set up. For this section, we will focus on episodic care or fee-for-service. In this model, a claim (bill) is submitted to the healthcare payer after each patient encounter. The standardized national claim form, maintained and distributed by the National Unified Claims Committee, is used. In addition to submitting patient and provider demographic information, they also send:

1. Evaluation and Management (E/M) CPT Code(s)

2. Modifiers and/or additional CPT Code(s)

3. ICD-10 Diagnosis Code(s)

The instructions for submission can be found online at the Center for Medicare and Medicaid Services (CMS). Most practice management software automatically extracts this data by interfacing with the EHR. Employed coding experts review the claims and may contact you to amend or add any codes. While they have some discretion on editing CPT coding errors, coders cannot change your diagnostic codes. Once reviewed, the claim is electronically submitted to the healthcare payer.

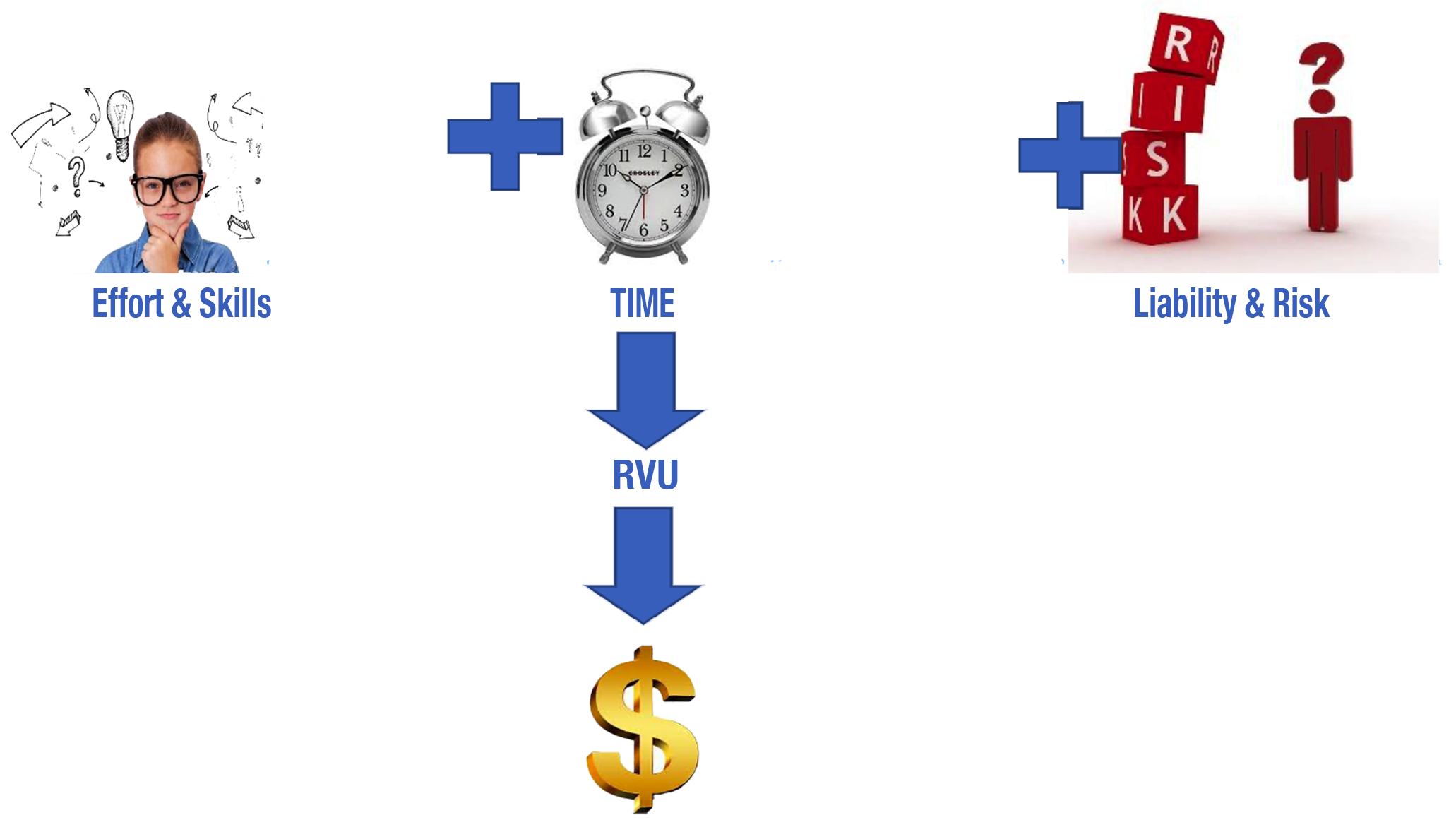

In order to convert these CPT codes into revenue, each code is assigned a standardized Relative Value Unit (RVU). This indicates how much each code is “worth” in terms of time, energy and provision of services. This system allows very different types of services to be converted into a number of RVUs and the base RVU is assigned a dollar amount for reimbursement. There are committees in the AMA to review and update CPT codes and their respective RVU values, along with proposing monetary reimbursement rates.

The definition of "work" for the RVU takes into account (1) the physician’s skill, effort and judgment, (2) the time taken by the physician and (3) the liability risk to the physician.

The AMA determines the conversion rate of CPT codes into RVUs and recommends an RVU conversion factor, on which the CMS bases their own official Physician Fee Schedule, adjusting it each year for inflation and other factors. There are geographic differences across the country in terms of the cost of living, running a practice, and malpractice insurance. Therefore, CMS divided the US into 89 geographic areas, with each region having its own Geographic Adjustment Factor. This does not change the RVU number, but it does adjust the final dollar amount that is reimbursed for each RVU, depending on the region of the country. The current conversion factor and the complete list of CPT codes can be downloaded from the CMS website. This CMS conversion factor is also used as a benchmark for other payers, although private health insurances may pay differently (sometimes better) than Medicare or Medicaid.

Also note that there is a Relative Value Scale, which is an index assigning various weights to various medical services within the total RVUs. Each weight represents a relative amount to be paid for each service. The relative value scale used in the development of the Medicare fee schedule for physicians consists of three components: physician work, practice expense, and malpractice expense. Each CPT code is weighted to include a different proportion of each type.

Thus total RVUs include:

1. Physician work RVU, which reflects the time, skill and oversight by the physician;

2. Practice expense RVU, which includes costs of nursing, other staff, and general expenses of the practice;

3. Professional liability expense RVU, which covers malpractice insurance premiums.

Many employed physicians are reimbursed based primarily on physician work RVUs (wRVUs). Physicians may be expected to reach a set yearly wRVU value to maintain their base salary and may receive additional income based on additional wRVUs generated (as incentive or bonus pay). Others may be reimbursed solely on collections from health insurance payers. Either way provides financial incentive for physicians who see more patients and do more procedures.

Just as hospitals have their own expenses, each practice also has business expenses, including employing nurses and other staff, clinic equipment, building costs, etc. These costs are reimbursed through Practice Expense RVUs. The RVU value for nursing visits or administering vaccines is weighted more towards reimbursing the practice rather than the physician. Conversely, physician services are weighted more heavily toward physician reimbursement (as wRVUs) and less towards the practice. Of total payments from CMS, about 52% goes to physicians for wRVUs, 44% covers practice expenses, and the remaining 4% covers malpractice insurance fees.

As an example, for a 99214 office visit in 2022, the total RVU is 3.76, of which the Practice Expense RVU is 1.79 and the Physician work RVU is 1.92. Contrast this to a 99211 nursing visit which has a total RVU of 0.69, of which the Practice Expense RVU is 0.5 and the Physician Work RVU is only 0.18.

Summary

We hope you see the importance of accurately reporting both CPT and ICD-10 codes, not only for documentation and good patient care, but also to allow you to be reimbursed appropriately for your work. If your CPT or ICD-10 coding are submitted incorrectly, this can reduce revenue to both you personally and to your practice. Slight modifications in your coding patterns will greatly reduce the time and stress on the coding reviewers and reduce the probability of a rejected claim. Over 20% of Medicare claims are incorrectly coded and other reports suggest that nearly 10% of all claims are rejected with each denied claim costing over $100 to correct! Yikes, that’s a lot of lost revenue! A little effort in learning billing and coding can go a long way to increase reimbursement.

Incorrect coding can lead to you needing to see more patients per day (to generate the same revenue you would have otherwise generated with better billing), which can impact the quality of care you provide and your job satisfaction. We want you to get paid for all your hard work and have a sustainable practice. Work smarter, not harder…